Surrey County Council spends over £1.1bn a year on delivering vital services such as adult social care, children's services, maintaining roads and pavements, Surrey Fire and Rescue Service, libraries, countryside management and public health.

The budget also outlines the council's five-year capital investment plan that will deliver more school places and improved school buildings, increased support for children with additional needs, road improvements, big infrastructure projects like in Farnham town centre, the River Thames flood defence scheme, grant funding community projects and increasing recycling capacity across Surrey.

The 2023/24 budget was agreed at a full meeting of the council on 7 February 2023.

As a result of increased spending across the council due to inflation and rising demand on services, Council Tax will rise by 2.99% this year. This rise, made up of a 0.99% core Council Tax increase and a 2% levy for adult social care, is equivalent of 94p per week for the average Band D bill.

Setting out the budget at a council meeting in February, Council Leader Tim Oliver said: "We believe it is essential to only levy the absolute minimum we need to meet increased costs – cost increases largely driven by inflation - in order to protect people's household budgets as much as possible at this time.

"We are making the decision to face this financial challenge in the fairest way possible, balancing our needs and ambitions with the immediate cost of living impact on our residents."

How the budget is spent

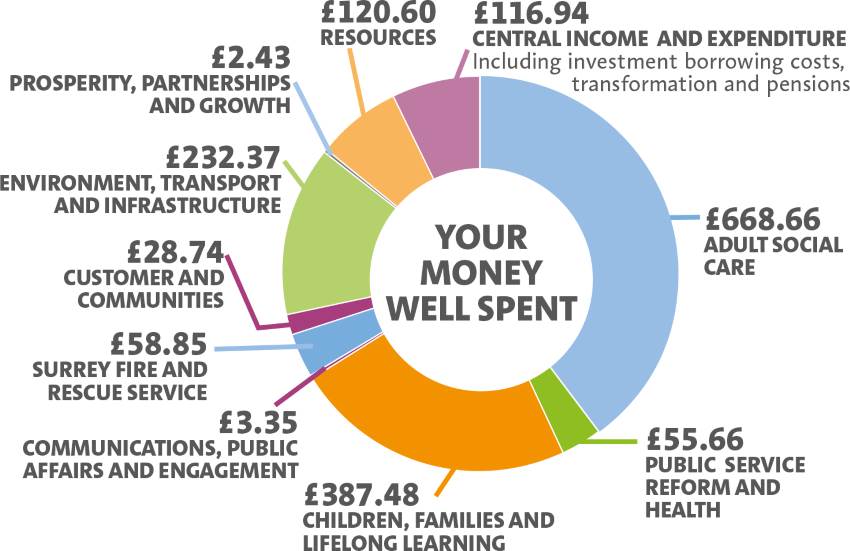

How the budget is spent can be seen below, including the equivalent spend for an average Band D bill.

For illustrative purposes, this represents the total budget split by the Band D council tax value. Some areas are funded by specific restricted grants, which are not reflected here. This is the county council's Band D figures only and does not include amounts raised by district and borough councils, Surrey Police or parish councils.

Adult Social Care

Looking after people with disabilities, severe needs, and as they get older.

£439.7m per year. (That is equivalent of £668.66 of annual Council Tax for a Band D property.)

Public Service Reform and Public Health

Working closely with our NHS partners to help people live healthier lives and keep them safe and well.

£36.6m per year. (That is equivalent of £55.66 of annual Council Tax for a Band D property.)

Children, Families and Lifelong Learning

Giving young people the best start in life, with additional care for those who need it and supporting education providers.

£254.8m per year. (That is equivalent of £387.48 of annual Council Tax for a Band D property.)

Environment, Transport and Infrastructure

Improving our roads and public transport, managing our countryside, and tackling the climate emergency.

£152.8m per year. (That is equivalent of £232.37 of annual Council Tax for a Band D property.)

Surrey Fire and Rescue Service

Keeping residents safe and responding to emergencies

£38.7m per year. (That is equivalent of £58.85 of annual Council Tax for a Band D property.)

Customer and Communities

Helping local communities thrive, providing libraries, registrations, customer services and funding grants.

£18.9m per year. (That is equivalent of £28.74 of annual Council Tax for a Band D property.)

Prosperity, Partnerships and Growth

Working with businesses and other partners to help grow Surrey's local economy

£1.6m per year. (That is equivalent of £2.43 of annual Council Tax for a Band D property.)

Communications, Public Affairs and Engagement

Making sure residents are well informed, can access services, and that Surrey's collective voice is heard.

£2.2m per year. (That is equivalent of £3.35 of annual Council Tax for a Band D property.)

Resources

Things like Surrey Crisis Fund, school meal provision, administrative support, IT, legal services, and management of council buildings to keep services running smoothly.

£79.3m per year. (That is equivalent of £120.59 of annual Council Tax for a Band D property.)

Central Income and Expenditure

Putting money into savings to help protect services in future, and repayments on borrowing used for our investment programme

£76.9m per year. (That is equivalent of £116.94 of annual Council Tax for a Band D property.)